3 Simple Techniques For Eb5 Investment Immigration

3 Simple Techniques For Eb5 Investment Immigration

Blog Article

Eb5 Investment Immigration for Dummies

Table of ContentsSome Known Questions About Eb5 Investment Immigration.The Buzz on Eb5 Investment ImmigrationThe Basic Principles Of Eb5 Investment Immigration Getting My Eb5 Investment Immigration To WorkNot known Details About Eb5 Investment Immigration The smart Trick of Eb5 Investment Immigration That Nobody is Talking About

buck fair-market worth. The minimum amount of funding required for the EB-5 visa program might be decreased from $1,050,000 to $800,000 if the investment is made in a commercial entity that is located in a targeted work area (TEA). To certify for the TEA designation, the EB-5 job have to either be in a backwoods or in a location that has high unemployment.workers. These jobs must be developed within both year duration after the financier has gotten their conditional long-term residency. Sometimes, -the capitalist has to have the ability to confirm that their financial investment brought about the development of direct tasks for employees that work straight within the industrial entity that received the financial investment.

Regional focuses administer EB-5 jobs. It might be a lot more advantageous for an investor to buy a regional center-run project due to the fact that the financier will certainly not need to individually establish up the EB-5 projects. Infusion of 8500,000 rather than $1,050,000 is not as difficult. Investor has more control over daily procedures.

The Buzz on Eb5 Investment Immigration

Capitalists do not need to create 10 tasks, however keep 10 already existing settings. Service is already distressed; hence, the financier may bargain for a much better deal. Financier has even more control over everyday procedures. Mixture of $800,000 as opposed to $1,050,000 is not as difficult. Removes the 10 staff member demand, enabling the capitalist to qualify without straight hiring 10 people.

Congress gives regional centers leading priority, which can suggest a quicker course to authorization for Type I-526. Capitalists do not require to develop 10 direct work, but his/her investment must develop either 10 straight or indirect jobs.

The financier needs to reveal the production of 10 work or potentially greater than 10 jobs if increasing an existing company. Risky due to the fact that business is located in a TEA. Have to generally reside in the same place as the enterprise. If company folds up within two year period, financier can lose all spent capital.

If business folds within two year period, investor can shed all spent resources. Financier requires to reveal that his/her financial investment produces either 10 direct or indirect work.

Eb5 Investment Immigration Things To Know Before You Get This

Normally used a placement as a Limited Obligation Companion, so capitalist has no control over daily procedures. In addition, the general partners of the regional facility company normally gain from financiers' financial investments. Financier has the alternative of purchasing any kind of business throughout the U.S. May not be as dangerous due to the fact that financial investment is not made in an area of high unemployment or distress.

Investors do not require to produce 10 tasks, yet Get More Information have to instead preserve 10 currently existing positions. Service is already distressed; hence, the investor might negotiate for a much better offer. Financier has more control over everyday operations. EB5 Investment Immigration. Gets rid of the 10 staff member requirement, enabling the financier to certify without straight employing 10 individuals.

The financier requires to keep 10 already existing employees for a period of at the very least 2 years. The organization is already in distress. Need to generally stay in the same place as the venture. Financiers might locate infusion of $1,050,000 extremely difficult and risky. If a financier likes to buy a regional facility firm, it might be far better to spend in one that just needs $800,000 in investment.

Excitement About Eb5 Investment Immigration

Capitalist needs to show that his/her financial investment Learn More develops either 10 direct or indirect jobs. The basic partners of the regional center firm usually profit from investors' financial investments.

for two years. We check your investment and task development development to guarantee compliance with EB-5 requirements throughout the conditional duration. We assist gather the essential documents to show that the called for investment and job production demands have been met. Prior to expiry of the two-year conditional permit, we send the I-829 application to eliminate problems and attain irreversible residency status.

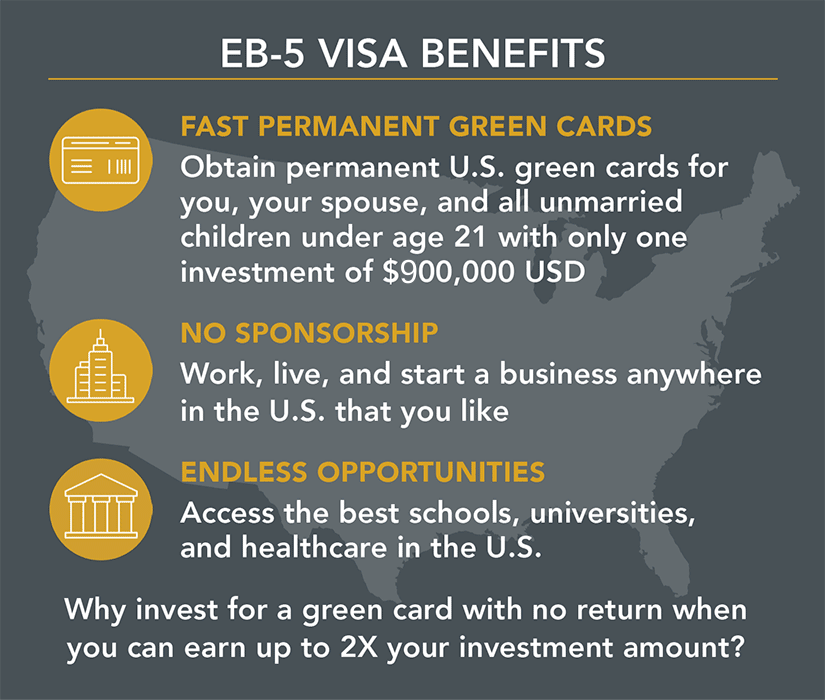

Recognizing what this requires, along with investment minimums and just how EB-5 financial investments accomplish copyright qualification, is important for any type of possible financier. Under the EB-5 program, capitalists need to fulfill specific funding thresholds.

TEAs consist of country areas or regions with high joblessness, and they incentivize task production where it's most required. No matter the amount or group, the investment has to be made in a brand-new company (NCE) and create at least 10 full time work for United States workers for an EB-5 applicant to receive residency.

Some Known Questions About Eb5 Investment Immigration.

The capitalist requires to maintain 10 currently existing employees for a period of a minimum of 2 years. Business is already in distress. Must typically live in the very same area as the enterprise. Capitalists might find infusion of $1,050,000 extremely cumbersome and high-risk. If an investor likes to purchase a local center firm, it may be far better to purchase one that just requires $800,000 in financial investment.

We check your financial investment and task creation progression to ensure conformity with EB-5 demands throughout the conditional period. We help collect the essential documents to show that the needed financial investment and work creation demands have been fulfilled.

One of one of the most vital facets is making certain that the financial investment remains "in danger" throughout the process. Understanding what this requires, along with financial investment minimums and exactly how EB-5 investments fulfill eco-friendly card qualification, is essential for any possible capitalist. Under the EB-5 program, financiers should meet specific funding thresholds. Since the enactment of the Reform and Integrity Act of 2022 (RIA), the basic minimum financial investment has been $1,050,000.

What Does Eb5 Investment Immigration Do?

TEAs include backwoods or areas with high unemployment, and they incentivize work production where it's most needed (EB5 Investment Immigration). Regardless of the amount or category, the investment must be made in a new company (NCE) and produce at least 10 full time jobs for United States workers for an EB-5 applicant to get approved for residency

Report this page